S2N

Members-

Posts

76 -

Joined

-

Last visited

Content Type

Profiles

Forums

Partners

Immigration Wiki

Guides

Immigration Forms

Times

Gallery

Store

Blogs

Everything posted by S2N

-

Pictures upload and misc.

S2N replied to JackandEdna2019's topic in IR-1 / CR-1 Spouse Visa Process & Procedures

I forget exactly where it was in the online form (they don’t let you go back and look at anything but the PDF version once you submit), but it was either that screen or near there. They gave a paragraph about needing to upload proof of marriage and the drop down contains multiple options for categorizing files including birth certificates and marriage certificates if I recall. Most of the stuff we uploaded was classified as “other.” They also read through everything uploaded and you can submit after as unsolicited evidence. -

Pictures upload and misc.

S2N replied to JackandEdna2019's topic in IR-1 / CR-1 Spouse Visa Process & Procedures

You upload as other evidence in the evidence of bona fides of marriage section. -

cr1 filing tax return single or married?

S2N replied to 75206's topic in Tax & Finances During US Immigration

Fraud is a strong word; @pushbrk is more or less correct except in the very specific circumstances I mentioned. The IRS will not go after you for intentionally filing in a less advantageous status than you could and paying more tax than you’ll eventually owe. The two asterisks are people living in community property states and people making $125k+ not counting their spouse. In both of those cases, you’re probably underpaying by reporting as single instead of MFS (though that can be amended to MFJ after they arrive so likely wouldn’t matter.) -

cr1 filing tax return single or married?

S2N replied to 75206's topic in Tax & Finances During US Immigration

Like I mentioned above, married filing separately has some weird results vs. single depending on what state you live in (community property changes stuff) and if your income is above $125kish, and the IRS could decide you owe more if they wanted to in those cases. But then you’d just file an amended return for MFJ and they wouldn’t care. -

cr1 filing tax return single or married?

S2N replied to 75206's topic in Tax & Finances During US Immigration

MFS complicates a lot because some states want a spousal ITIN even if said spouse has no ITIN, and a lot of people don’t want to do the legwork to do MFJ. We’re doing MFJ federally and have to go on extension at the state level, where I’m filing MFS (beneficial on our state taxes) because my state tax authorities want an ITIN even for MFS. MFS aleo has negative tax consequences when you’re in “upper” incomes, which start a lot sooner than you think if you’re in a HCOL area. Stuff like that is why people file single even when they’re married and then amend to MFJ once the spouse is in the U.S. I’m of the opinion MFJ federally is the best, but I understand why plenty still file single and then amend. -

January 2025 I-130 Filers

S2N replied to S2N's topic in IR-1 / CR-1 Spouse Visa Case Filing and Progress Reports

Progress tab means nothing. It’s widely regarded as inaccurate. -

The question isn’t if you met before, but if you physically met in person after the marriage. If I’m reading this correctly it’s saying you’ve lived together in the Philippines after the marriage. That’s sufficient. You’d provide your Utah marriage license, entry stamps into the Philippines. Any evidence of living together there also provides proof of a bona fide relationship.

-

W-2 does not say someone owes taxes on those amount to the U.S. government— it is an informational schedule reported to the IRS on your earnings. Tax liability is a different question and that’s one that OP and their tax preparer are responsible for coming up with the initial answer to on a 1040. The complication here is that most countries tax-based on physical presence. The US has a worldwide tax system for natural persons, and FEIE is designed to alleviate the burden of double-taxation on wage earners without having to get into complicated tax treaties. Presumably OP does owe tax to his country of residence due to earning the income there, but that is not a requirement to claim it. OP should talk to an accountant who has experience with the tax laws of both the United States and country of residence to see the tax implications here — I’d suggest a CPA or tax attorney and not just an EA. Probably one of the certified acceptance agents for form W-7 in the country would be a good place to start since they regularly handle both US and country of residence issues. In terms of immigration: if you take the exclusion I’d line up a joint sponsor if possible.

-

Protecting Permanent Residency under Same-sex Marriage

S2N replied to DD/JP's topic in General Immigration-Related Discussion

We got married in the U.S. to start immigration before Trump, but it wasn’t because we were worried about our marriage not being recognized. The difference between Roe and Obergefell is that Obergefell is widely popular, has bipartisan support, and all gay rights cases since have only expanded the rights of gay people, and were by-and-large written by conservative justices (Bostock v. Clayton County is arguably more important than Obergefell and it was written by Neil Gorsuch.) Trump is hostile to trans rights, but he’s never really been opposed to gay rights in any of his campaigns of terms. I only mention that as a lot of the angst many gay people feel relates to Trump, and while I get it, he’s never really been anti-gay, at least in recent memory. Anyway even if it was overruled, there’s precedent for this previously — in the 2000s and 2010s when courts would allow gay marriage then states would amend their constitutions to ban it again, anyone who was married before the re-ban was treated as married by the state that had issued the license. -

The most frustrating part about this process

S2N replied to holi's topic in IR-1 / CR-1 Spouse Visa Process & Procedures

The question is what in the process is judgmental vs. what is verifying a box has been checked. For a straightforward case (no crimes, foreign divorces, etc.) the only thing that really requires human judgment is the determination of if a marriage is bona fide. That’s something that can be handled at the embassy (and de facto is already, USCIS rarely questions on that point. Consular officials overwhelmingly are the ones rejecting visas for fraudulent marriage reasons.) Most if not all of what USCIS does can be automated, and that would align with DHS’ other initiatives to take human judgment out of what it does. Global entry and TSA screenings now are just humans telling you the computer has decided you’re good. -

The most frustrating part about this process

S2N replied to holi's topic in IR-1 / CR-1 Spouse Visa Process & Procedures

Apologies for not being more specific. The 1996 Welfare Reform Act requires it in every state as a matter of federal law for anyone who has been issued an SSN. My husband didn’t need one either, he showed his Chilean passport. I had to provide a SSN and proof and this is standardized across the states to be in compliance with federal law. It would be trivial for USCIS to match petitioners to marriage licenses with SSNs and then do an automated name match for the beneficiary. The petitioner SSN would be sufficient to locate the license. They already do something similar with eVerify. Would be more difficult for people married in foreign countries, but even then given the information sharing between DHS and many foreign interior departments it probably could be overcome. -

5 YEAR BAN THEN I130 FOR WIFE

S2N replied to omar42's topic in IR-1 / CR-1 Spouse Visa Process & Procedures

Because people get nervous around immigration officials and say stupid things when answering the question truthfully, nothing more, nothing less is all that you need to do 99% of the time to be admitted into any country. -

The most frustrating part about this process

S2N replied to holi's topic in IR-1 / CR-1 Spouse Visa Process & Procedures

Verification of US citizenship of the sponsor can fairly easily be automated. USCIS already runs eVerify, which works with things as manual as birth certificates. Given that SSNs are required nationally for a marriage license issuance and usually maintained in a database by the state in order to facilitate suing someone for child support, it should also be fairly simple to automate verification of a valid marriage. An easy reform of the process would be to have USCIS handle only the verification of sponsorship eligibility, which can easily be automated, and punt 100% of the manual stuff to the Department of State. Most of the denials for bona fides come at the consulate level anyway, because USCIS does a horrible job of identifying fraud. It likely wouldn’t add to the backlog either. Worst case would be current USCIS wait times would be shifted to NVC. It’s not going to happen though. A lot of what USCIS does is a jobs program, and the congressional GOP is currently getting angsty that the cuts from Musk might start leaving Washington and hitting the non-DMV areas where they were able to set up federal offices. There’s a reason many of the service centers and field offices are in red districts. -

Should i put income as zero on I-864?

S2N replied to Kossaga's topic in IR-1 / CR-1 Spouse Visa Process & Procedures

Also, OP, your story here is hard to follow. You said you filed your taxes but then are asking if you have to file your taxes if you’re above MA but below federal? The short answer is yes, you have both a federal and state filing requirement any year you made more than $400 self-employed, but also the State Department doesn’t care to see your MA return and the state return won’t have an immigration impact. If you’ve filed a federal return you put in the total income amount from your 1040 and upload the transcript. -

Should i put income as zero on I-864?

S2N replied to Kossaga's topic in IR-1 / CR-1 Spouse Visa Process & Procedures

@pushbrk is normally spot on I-864, but there’s a detail here he glanced over — you have self-employment income. The $400 is not just a state requirement like you think it is. If your self-employment income was $400 or more there is a federal filing requirement as you owe self-employment tax even if you do not owe income tax. You most likely will not owe income tax, since your taxable income will be zero; but you’ll most likely owe 15.3% self-employment tax on the net income listed on schedule C. Self-employment tax is calculated on Schedule SE before the standard deduction and any adjustments is are applied to get taxable income on the face of the 1040. Just use FreeTaxUSA and file your taxes. IRS page for reference: https://www.irs.gov/businesses/small-businesses-self-employed/self-employed-individuals-tax-center#:~:text=You have to file an,and 1040-SR instructions PDF. -

Ask him to go online and download his tax return transcript. That should clear it up and avoid any back and forth. If he has no W-2 and you can explain it, it’s fine, but the transcripts are easy to get and eliminate the need in most cases.

-

When you say you want to travel back to the U.S., is it permanently because of a job offer or just to visit as tourists? If permanently and you have a job offer, etc. you could potentially see if the local consulate is willing to entertain Direct Consular Filing (DCF) for the children while the spouse is overseas. More experienced posters might have thoughts on how likely this is, but it’s free to ask the local consulate if they’d accept.

-

That’s what we did as well; in addition to being the right thing to do, it makes future business with the government easier if you have to worry about getting a security clearance in the future or providing/working on government contracts, plus whatever potential future issues could arise when trying to naturalize if a future administration decides to issue guidance on standards of review of people who AOS’d on an overstay. My initial response was mainly to let you know that there’s not much to worry about. You’re intending to follow the law. Currently USCIS and CBP aren’t even prioritizing enforcing the law for blatantly fraudulent spousal overstay AOS cases. If you’re intending to follow the law and you have a decent way to show that’s the intent, there’s a very low chance of there being issues at the airport or when filing a petition.

-

Sorry for beating a dead horse but your wording here is a bit ambiguous. The requirement isn’t 5 consecutive years. It’s 5 total years in your life, including two after 14. Doesn’t need to be 5 recent years. Doesn’t need to be 5 years before birth. It’s 1825 total days in your life with 730 days being after 14.

-

What is a DS-2019? And how to get a copy?

S2N replied to lanc3r30000's topic in IR-1 / CR-1 Spouse Visa Process & Procedures

I would reach out to the U.S. sponsor and see if they have it. If it’s a government sponsor and they say they can’t find it FOIA them to get the people who are skilled at finding records involved. -

What is a DS-2019? And how to get a copy?

S2N replied to lanc3r30000's topic in IR-1 / CR-1 Spouse Visa Process & Procedures

If it was a public institution try a state level FOIA request. That’ll get the public information officer involved and lead to a more thorough search (hopefully.) Might take longer, but if you’ve already reached out worth a shot. -

If the children are indeed US citizens, depending on the timeline OP could apply for a passport with secondary evidence rather than apply for a CRBA and then a passport. A US passport is definitive evidence of US citizenship and it’s an entitlement of a citizen even if they don’t have previous primary documentation of citizenship. OP would just need to prove presence in the U.S. for five years, two of which after the age of 14. Could be accomplished by social security statements, high school or university transcripts, employment contracts/paystubs, leases, etc. Essentially the same evidence as a CRBA. Obviously getting a CRBA would be preferable first, but if there’s a time crunch that step can be skipped. I’d recommend getting one or a citizenship certificate as well after getting a passport since those never expire, but there’s also other options if there’s a rush to travel.

-

If their plans change it’s allowed. What’s not allowed is planning to do it on entrance, though USCIS basically overlooks that type of fraud these days. ESTA->Green card and AOS after 91 days and claiming plans changed is averaging 4-6 months these days and is easily the quickest way for a loved one who resides overseas to become an LPR. Under Biden legalizing those overstays became the priority vs. processing consular applications. Like @pushbrk I’m not suggesting that just pointing out the elephant in the room. I’m doing consular processing and I think it’s the right thing to do, but even under Trump USCIS has taken a very lenient approach to AOS for spousal overstays on ESTA, and is approving them at a quicker rate than counselor cases.

-

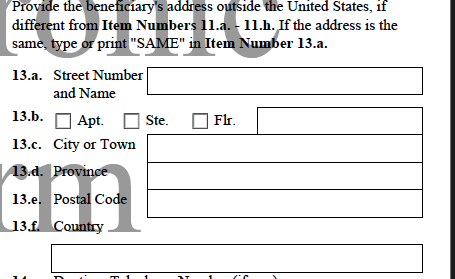

Someone on Reddit mentioned to double check the signature sections for online filed I-130s because apparently its been a trend for people to sign them wrong, and while I didn't screw that up, while I was scanning through it I noticed that my response to question 13 (my husband's residence outside the US) was showing up as blank on the PDF (screenshot attached.) I vaguely remember getting an error on the online form when trying to type in SAME because it didn't like for formating or something like that. Since we'd already provided his physical address is leaving this blank something I need to be worried about or should I submit unsolicited evidence clarifying it?