-

Posts

381 -

Joined

-

Last visited

Content Type

Profiles

Forums

Partners

Immigration Wiki

Guides

Immigration Forms

Times

Gallery

Store

Blogs

Everything posted by Rachel n Tyler

-

March 2025 AOS Filers

Rachel n Tyler replied to KStr2022's topic in Adjustment of Status Case Filing and Progress Reports

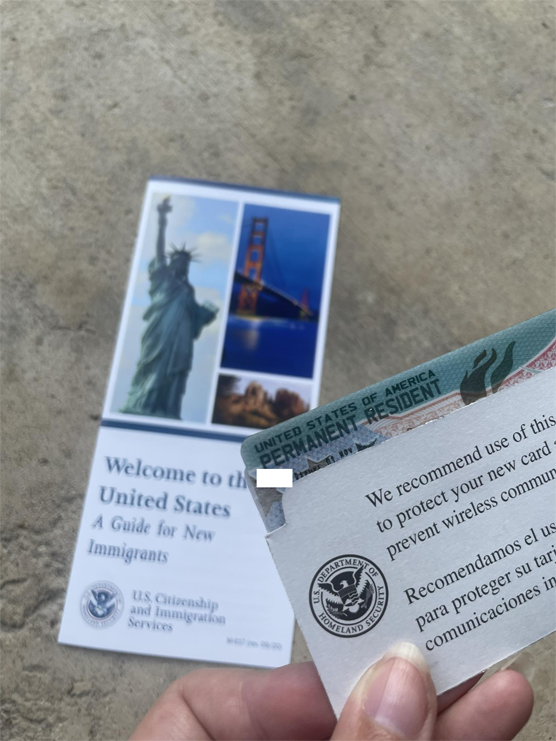

THANKYOU! A big sigh of relief for the next year+. Now just getting my drivers license -

March 2025 AOS Filers

Rachel n Tyler replied to KStr2022's topic in Adjustment of Status Case Filing and Progress Reports

-

March 2025 AOS Filers

Rachel n Tyler replied to KStr2022's topic in Adjustment of Status Case Filing and Progress Reports

Apparently my green card is arriving tomorrow.. 8 days after approval, 9 after interview. Damn! -

The first one was due to a mistake on the 485. I accidentally marked that I was filing as a spouse of a USC, but I was filing as a K1 visa holder. Very confusing as I am a spouse lol. The second one was due to money. The bank took some money related to a car loan (even though it had been paid off, just a fee or something months after) that made our balance a little lower than the amount they tried to pull... So that's another rejection lol. We went with money orders after that to not have that risk again. Really simple dumb rejections haha

-

My worry was sounding too rehearsed/robotic. And my husband is a talker, so I doubt he'll ever give short answers LOL. But we'll keep this in mind for the next time, if needed. And yeah, there's nothing on my phone I'm worried they'll find, but one thing out of context can get you in so much trouble... So that's also partially why I didn't want to risk it at all!

-

Hi guys! I figured I'd type out my experience. Especially since I haven't seen a lot of detailed experiences/reviews, might as well! Our interview was the 10th of September. 9:30am, bright and early! We arrived at 9:07am and saw a few people arriving. There's a LOT of parking for visitors, so no need to worry about that. We left our phones in the car, but you do not have to. We walked in to the building and had to go through security. Have your appointment letter ready! That's the first thing they ask for. Then you have to put your phone, wallet etc in a little box for the xray thing. Walk through a detector. Then you walk over to a little podium where someone points you to the right window. There were about 4 couples in front of me, not too bad. They took my ID, appointment letter, photo and 2 fingerprints. She then wrote a number on my letter and told us to go upstairs. They'd call us by our names. We then went up to the next floor and saw quite a few people waiting. I wanna say around 40. I kinda panicked knowing we didn't have our phones. Last time I did my K1 interview in Germany there was about the same amount of people, probably even less, and I waited for about 4-5 hours. Without food, entertainment... So that sent me back there. BUT, I think we waited for less than 15 minutes. We were fooling around checking receipts in our wallets when they called my name. We then followed the officer to her cubicle/room. She didn't say much, that made me nervous, but I just went with the flow. We got sworn in and she started by confirming our adress. We moved a week before and I had changed it in USCIS, but it hadn't changed on her end. So we confirmed my new one. She then asked How we met/how our relationship started. I started explaining, then my husband started adding information. I think she didn't hear me clearly or didn't listen, because she didn't understand we met online until AFTER my husband added some things to the story. She then asked How did you build your relationship/life since moving? It was something like this. My husband took the lead on this one and was very vague. This made me EXTREMELY nervous because I could tell the answer was not what she was looking for. But she continued with another question before I could add anything. She then asked Did you work unauthorized? I was honest and told her no. I even joked saying I was glad to not have to work for a little bit and just relax at home. She laughed, this put me at ease. She also added I'm a full time dog mom anyway (dog was mentioned in the previous questions+pictures). She asked if I had any new evidence to add, which I did, a new 864 due to a job change. She kinda skimmed it and didn't seem to want to do too much with it. I forgot to give her the paystubs and employer letter, so that sent me in a panic once I realised while we were driving back home. She then started asking the yes/no questions. She began with the ones I put 'yes' on on the 485. It was 13 and 76 top of my head. It was about overstaying/violating the terms of my visa. I explained that our AOS got rejected twice, and due to the rejections I overstayed/filed AOS too late. She nodded and seemed satisfied with the answer. A few questions were asked, like if I helped traffic people, drugs, if I ever killed someone, stuff like that. At one question, one about government assistance, my husband cleared his throat right after I said no. I looked at him in panic and said Babe now she thinks I'm lying!!!! We all laughed. She mentioned she is sniffly too due to the aircon being on on that side, another officer has a space heater and it trips up the AC. Was kinda funny. She then asked if we had anything else to add. I said nope. I offered her stuff we brought like my husband's birth certificate, but she didn't need them. We joked about the BC since we had to drive to Oklahoma to get it, so it was a 7h round trip. She said it was a good bonding experience and we laughed. She then explained that the case would now be reviewed again and once we hear back, it usually takes 30-60 days before you get the card. Something like that. She said a few other things but nothing that really stuck in my mind. I was honestly kind of dissapointed that we weren't approved on the spot. Atleast I thought. We then went to the car and it was 9:52. So that was crazy! I kept checking my USCIS account for news until Edward & Jaycel here told me that the system takes 24h to notify us of any changes. So then I gave up LOL. The next morning I woke up at 10:30, checked my phone and saw the email. 'We have taken an action on your case'. I quickly logged in, hoping but thinking it would just be the change to 'reviewing'. BUT! It said I got approved!!!! The email arrived 10am, so I'm guessing we were approved on the spot but just not told. I think that's all? It all feels like a fever dream now LOL.

-

March 2025 AOS Filers

Rachel n Tyler replied to KStr2022's topic in Adjustment of Status Case Filing and Progress Reports

thanks guys!!! I feel so lucky we got it one day after the interview. We can BREATHEEEEE!! -

March 2025 AOS Filers

Rachel n Tyler replied to KStr2022's topic in Adjustment of Status Case Filing and Progress Reports

AAAAAAH IVE BEEN APPROVED GUYS -

March 2025 AOS Filers

Rachel n Tyler replied to KStr2022's topic in Adjustment of Status Case Filing and Progress Reports

Alright so tomorrow afternoon the checking starts.. Gotcha 😜 That's very helpful to know though, thank you! -

March 2025 AOS Filers

Rachel n Tyler replied to KStr2022's topic in Adjustment of Status Case Filing and Progress Reports

Ahhh okay, that puts my mind to ease a little bit hahaha. I guess now we’ll be checking my email every 10min to see if anything changes LOL -

March 2025 AOS Filers

Rachel n Tyler replied to KStr2022's topic in Adjustment of Status Case Filing and Progress Reports

LOL. I sometimes was thinking ‘honey I’m sure she doesn’t care where the nearest A&W spot is…’ but yknow, just let him yap!! I just hope I didn’t forget anything due to nerves and his talking hahah. We’re gonna scan everything we can to prepare for anything that comes up next. only odd thing is we didn’t get anything that said ‘hey you had your interview’ like I’ve seen here, but maybe that’s just office specific? I hate how basically you’re just still back to waiting LOL -

March 2025 AOS Filers

Rachel n Tyler replied to KStr2022's topic in Adjustment of Status Case Filing and Progress Reports

My husband mostly just kept yapping, maybe that saved us LOL -

March 2025 AOS Filers

Rachel n Tyler replied to KStr2022's topic in Adjustment of Status Case Filing and Progress Reports

Interview done! She mostly asked the yes/no questions, asked how we built our life together since I moved here, she was a bit joke-y, so that made my nerves less. Outside of the new 864 she took nothing and then we were let go. She said it’ll be reviewed and if accepted we’d receive the card between 30-60 days. It was hard to read her but I think it went well? -

March 2025 AOS Filers

Rachel n Tyler replied to KStr2022's topic in Adjustment of Status Case Filing and Progress Reports

I hope so!! Reading up a lot to hopefully not make easy mistakes haha -

March 2025 AOS Filers

Rachel n Tyler replied to KStr2022's topic in Adjustment of Status Case Filing and Progress Reports

Alright, thanks guys! Hopefully that can calm him down a little bit haha. -

March 2025 AOS Filers

Rachel n Tyler replied to KStr2022's topic in Adjustment of Status Case Filing and Progress Reports

It’s just that it says on the interview letter we need it.. It just pisses me off because it’s a big company, how does it take weeks to have a letter state his hours and wage? -

March 2025 AOS Filers

Rachel n Tyler replied to KStr2022's topic in Adjustment of Status Case Filing and Progress Reports

So our interview is in 2 days! Yippie! However, my husband can’t seem to get his letter from his new job stating his average hours and pay. We’ve been trying for weeks and they’re just stringing us along. I swear this will send me into a panic attack -

March 2025 AOS Filers

Rachel n Tyler replied to KStr2022's topic in Adjustment of Status Case Filing and Progress Reports

Most of it has been uploaded so far yes. Some of it was new and I haven't yet, doing it this weekend! I was hoping to get all of it to scan it at once, but issues adding me to the insurance so might as well upload everything anyway. Do you recommend adding everything in separate files or just one big pdf for all of it? I'll make sure he remembers that we answered yes to two questions (about breaking visa terms due to my paperwork being rude lol) so we won't get in trouble lol -

March 2025 AOS Filers

Rachel n Tyler replied to KStr2022's topic in Adjustment of Status Case Filing and Progress Reports

I'll make sure to study what I wrote, and make my husband study too LOL. I wrote the truth, so I don't think I'd say anything different. But it's smart to check over just incase