-

Posts

938 -

Joined

-

Last visited

Content Type

Profiles

Forums

Partners

Immigration Wiki

Guides

Immigration Forms

Times

Gallery

Store

Blogs

Everything posted by EatBulaga

-

You can use Part 8. Additional Information (and include extra copies of Part 8, if needed) to explain briefly some milestones of your bona fide relationship, and mention that you are including photo evidence, tickets, etc. in the I-129F. But focus more evidence on the last 2 years of meeting in person like pictures with family members, etc. We had evidence of 5-year relationship before petitioning for the K1, and made very clear when in the last 2 years we were together in person.

-

@dreamer32 @toor09 FWIW, VJ members who filled out the Timeline show the average days at NVC is 53 days. It's very possible you may be on the higher end of the average. https://www.visajourney.com/timeline/stats.php Also for the Ankara consulate, the average days between the consulate receiving information from NVC to the actual interview is 112 days. For Islamabad, the average is 34 days.

-

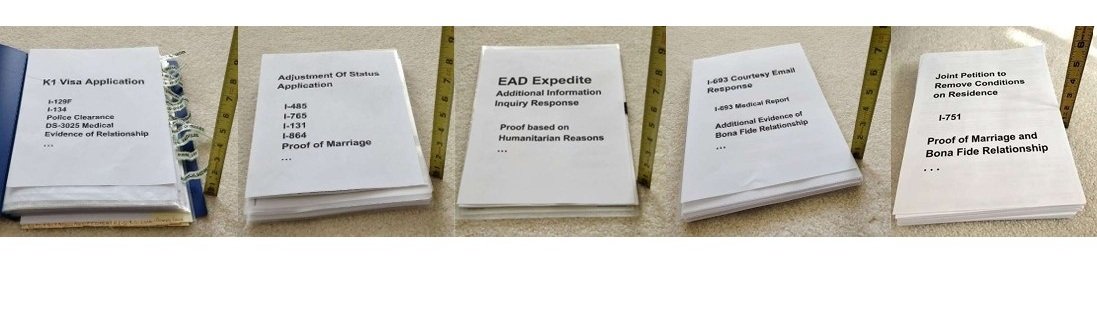

As @OldUser link shows, USCIS Tips for Filing Forms by Mail recommends not using binders, folders, heavy-duty staples, etc., or anything that can not easily be disassembled. We wrapped our 2-inch stack with 2 long rubber bands since we read others using them in their package. We put the rubber-banded stack inside the FedEx medium plastic envelope cover sealed to protect it from moisture. And we shipped everything inside the FedEx medium box. After USCIS receives the package, they want to disassemble it quickly and put the documents in a stack scanner. So think about how your package can be easily disassembled and less prone to human errors? @Yu1988 It doesn't hurt to mention "no lease or mortgage contracts because our house had already been paid off before we get married" in Part 11. Additional Information, listing, Page Number: 3, Part Number: 5, Item Number: 6. The cover letter may or may not be looked at much, but anything in the I-751 will be looked at to make it very clear why you have homeowner insurance in both names, but no lease or mortgage.

-

K1 Process Advice

EatBulaga replied to Alex3132428's topic in K-1 Fiance(e) Visa Process & Procedures

Make sure you document your visits as extra evidence (pics, tickets, etc.) in case the consulate interviewer asks for it. We included the extra evidence at the end of the I-134. -

N-400: online vs paper application

EatBulaga replied to EatBulaga's topic in US Citizenship General Discussion

That's not an advantage for paper application being more expensive. I'm asking if paper application has any advantage over online application? -

N-400: online vs paper application

EatBulaga replied to EatBulaga's topic in US Citizenship General Discussion

Actually. Online fee 710 is cheaper than paper application fee 760. I'm wondering if I missed any advantages that the paper application has over the online application? -

Hello Everyone, What is the advantage of applying the paper form over the online application? For the 3-year marriage-based N-400, does the online application allow for uploads of multiple files for bills, bank/credit statements, etc.? Thanks in advance.

-

K1 Process Advice

EatBulaga replied to Alex3132428's topic in K-1 Fiance(e) Visa Process & Procedures

RFE gives you the chance to correct your errors and strengthen your case. Just need to make sure you submit on-time. -

K1 Process Advice

EatBulaga replied to Alex3132428's topic in K-1 Fiance(e) Visa Process & Procedures

@Alex3132428 FWIW, the K1 visa processing times have improved some since the pandemic when we applied. https://www.visajourney.com/times/k1-fiance-visa-historical/ I would follow your lawyer's advice about the letter of intent and not worry about it unless you get an RFE. -

First, please fill out your Timeline as your data can help others and others know your USCIS status to help you. Did you file concurrently I-485 and I-765? Past K1 process time is irrelevant to AOS or EAD process times. I-485 expedite approval is rare and hardly worth pursuing, and may slow your approval. I-765 expedite is more feasible provided you can prove certain criteria and circumstances listed here https://www.uscis.gov/forms/filing-guidance/expedite-requests Remember the AOS and EAD are petitioned by the foreign spouse and financially supported by the US sponsor(s) so proof of severe financial loss may contradict the I-864 filed. Some have used a job offer as reason for loss to the company, etc. No cost to I-765 expedite. You can get your congressman to inquire the case status for you, but you have to request expedite yourself. Yes, you need a reason listed for expedite. If you see our past I-765 expedite, we used humanitarian reason for our i-765 expedite. https://www.visajourney.com/forums/topic/789757-is-expiring-drivers-license-reason-for-expediting-ead/#findComment-10792667

-

I-751 evidence

EatBulaga replied to Aoife&Cam's topic in Removing Conditions on Residency General Discussion

You can compare your list to our's at https://www.visajourney.com/forums/topic/827917-what-do-you-think-about-this-cover-letter-i-751/ Our's was about 2 inches thick sent in the medium FedEx box with plastic wrapped and rubber banded inside. Got to Elgin, IL, overnight. -

She can travel to PH with maiden name passport, and return to US with her green card and marriage certificate to link the name on the passport to the green card. The flight ticket name needs to match the passport. If you want a PH ROM, then have another marriage in the PH with the proper paperwork. The marriage date will be different on the PH ROM from the Pennsylvania marriage certificate.

-

First, please fill out your Timeline. No one has any idea of where you are in the USCIS processing? CR1/IR1? EAD? Conditional green card? Etc.? Second, did your foreign spouse gain marriage based status by "self-uniting marriage"? Which US state? One of the closest to "self-uniting marriage" recognized by some states is common law marriage like Texas. Even Texas common law marriage can have a county clerk registry called declaration of informal marriage, which is a document/record that can be used for USCIS applications or maybe PH Report Of Marriage? Third, foreigners can travel out of the country with passports in maiden name. What returning US Entry document does your foreign spouse have? If the US Entry document name is different from passport name, what document of registered marriage or name change document can link the two document names?

-

You show your immunization card/record to the medical exam doctor to decide.

-

When to get an ID and a driver's license

EatBulaga replied to Zen77's topic in Moving to the US and Your New Life In America

In Georgia, we had to re-apply my foreign spouse's state ID/DL as we progressed through with the I-94 to EAD to AOS to ROC. https://www.visajourney.com/forums/topic/828891-georgia-dlid-with-ead-aos-roc-experience/ It was a pain going back to the DDS each time, and making sure every application opts out of voter registration. I Hope Illinois is not as strict? -

State ID Card & ACA - No SS Card (yet)

EatBulaga replied to Tesco's topic in Moving to the US and Your New Life In America

If you have the SSN, that is really all the health forms ask. We didn't file for the ACA but with my health insurance, and the online form just asks us to type in the SSN. As for the DL with the DMV/DDS, that depends on the state. In Georgia, they just asked us for the SSN, and not the card. https://www.visajourney.com/forums/topic/828891-georgia-dlid-with-ead-aos-roc-experience/ Depending on which ACA or which state, yes get the SSN card as soon as you can. -

Tax Transcript

EatBulaga replied to RobertHopkins's topic in Removing Conditions on Residency General Discussion

I forget where I read it on VJ. But for AOS, it was recommended to not upload unsolicited evidence. This might be a remnant from the paper-based applications and evidence? I'm just extrapolating to ROC. Things may have changed as USCIS continues to migrate to digital systems. -

I-751 January 2025 Filers

EatBulaga replied to Qui's topic in Removing Conditions on Residency General Discussion

So one of the first things we did after getting the 48-month extension letter was to update my foreign spouse's DL. For anyone interested, I posted our experience with the Georgia Department of Driver Services at https://www.visajourney.com/forums/topic/828891-georgia-dlid-with-ead-aos-roc-experience/ -

My foreign spouse had a chatmate in Georgia who reported the DDS did not grant them a DL or state ID because they did not recognize the ROC 48-month extension letter. So this is more of a PSA (public service announcement) for those looking for a report of successes with the Georgia Department of Driver Services (Georgia DDS) after getting the EAD, AOS, or ROC extension letter. We have experience with all three. This complements our USCIS-related events in our Timeline or at our Profile->Our Story. Each state has its own DMV or DDS requirements which may differ from Georgia. https://dds.georgia.gov/ But for Georgia, the requirements for foreigners are listed at https://dds.georgia.gov/information-non-us-citizens Our first experience after my K1 beneficiary POE was to get her a state ID (2022-06). Right after the I-94 became available online, we took the I-94 with her foreign passport to apply for her SSN. It took about a week to get her Social Security card in the mail, and we then took that along with her I-94 and foreign passport to the DDS to get her Georgia state ID. Georgia only offers the state ID valid to the I-94 expiration. But Georgia DDS will extend with a one-time card extension of 120 days with an I-797C Notice Of Action with the expired immigration document. So with a state ID expiring in less than 90 days, we sent off the AOS I-485, I-765, and I-131. While waiting for the AOS I-797C, my newly wedded foreign spouse was preparing for her written test for a driver's permit. After we received the AOS I-797C, we went back to the DDS to extend the state ID near the end of her I-94 expiration and to take her written test (2022-09). She passed the written test. So she got a state ID AND a driver's permit for another 120 days. Yes, we paid for 2 cards and both cards had the same license number and expiration date. In retrospect, we just need the driver's permit as that qualifies for the REAL ID as well. My foreign spouse then passed the driving test for her driver's license in 2022-11, but Georgia DDS only granted her DL to the end of the 120-day state extension which was 2023-01. So nearing her 7-month mark in the US (90-days I-94 + 120-days I-797C state extension) and no I-485 approval in sight, we filed for an I-765 expedite (2022-12), and received the EAD/AP combo card (2023-01). The EAD/AP combo was for 2-years and Georgia DDS then extended her DL to 2025-01. The AOS was approved in 2023-04, and back we went to the DDS with her conditional green card to extend her DL to 2025-04. The ROC was filed 2025-01, and we received the 48-month extension letter in 2025-02. We took the soon-to-be expired green card and DL along with the 48-month extension letter to extend her DL to 2029-04. Since my foreign spouse had a chatmate who experienced difficulties with the DDS with the 48-month extension letter, we went to the Norcross DDS, which serves many immigrant communities to renew her DL with the ROC 48-month extension letter. They recognized it as no problem, but the wait was long (about 1.5 hours). In all our applications for the ID/permit/DL, we made it very clear to the DDS to opt out of voter registration. So this isn't exactly an AMA (Ask Me Anything). But if anyone has questions, I'll try my best to answer based on our experience?

-

Tax Transcript

EatBulaga replied to RobertHopkins's topic in Removing Conditions on Residency General Discussion

@OldUser I agree to file as soon as possible but I wouldn't upload unsolicited evidence. I've sent requested evidence twice as instructed by USCIS. The first was for EAD and the instruction was to fax to a specific number. Second was the I-693 courtesy email instructions to upload to the document tab. Unless some specific USCIS officer request, I don't think the unsolicited evidence will get priority or will get looked at to expedite the process. If anything, it might delay the processing. -

N400 wait times

EatBulaga replied to dvensel1's topic in US Citizenship Case Filing and Progress Reports

I don't think this is a Filipina question but a N-400 question. The N-400 data are at https://www.visajourney.com/timeline/citstats.php Also, filing N-400 online is cheaper and may be faster than sending in the mail. The possibility of a biometric appointment may mess with your schedule. -

I-751 January 2025 Filers

EatBulaga replied to Qui's topic in Removing Conditions on Residency General Discussion

As a general rule, we don't upload additional evidence unless USCIS requests it. It could delay the processing. The only time we did upload additional evidence was from the i-693 Courtesy Email instructions which we fulfilled. -

US to Philippine airline carriers (ticketing issues)

EatBulaga replied to spicynujac's topic in Philippines

@spicynujac have you tried calling the airline directly to book a ticket?